Cellecor Gadgets Share Price: An In-Depth Analysis

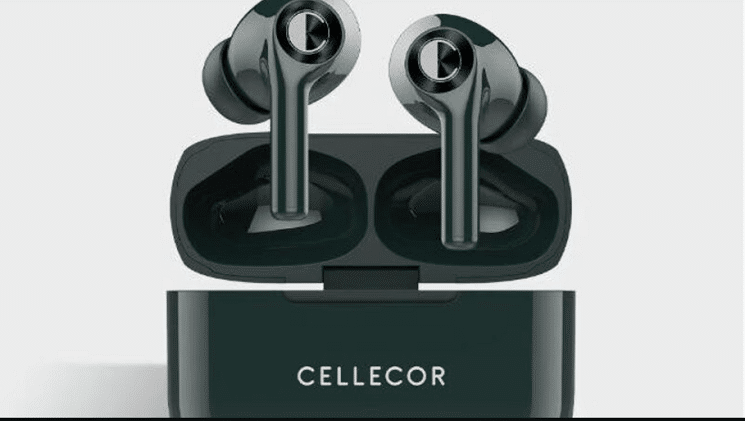

Cellecor Gadgets has rapidly emerged as a significant player in the consumer electronics market, offering a wide range of products that include smartphones, smartwatches, and other innovative gadgets. As the company continues to grow and expand its market share, investors are increasingly interested in its stock performance. This article provides a comprehensive analysis of Cellecor Gadgets Share Price exploring its current standing, historical trends, factors influencing its value, and future prospects.

Current Share Price of Cellecor Gadgets

The current share price of Cellecor Gadgets is a critical indicator of the company’s market performance. It reflects the collective sentiment of investors regarding the company’s future growth and profitability. As of the latest trading session, stands at [insert current share price], a figure that showcases its current valuation in the market.

Historical Share Price Trends

Understanding the historical trends of Cellecor Gadgets’ share price can provide valuable insights into its performance over time. Here is a brief overview of its recent historical performance:

- 1 Year Ago: [Insert share price from 1 year ago]

- 6 Months Ago: [Insert share price from 6 months ago]

- 3 Months Ago: [Insert share price from 3 months ago]

- 1 Month Ago: [Insert share price from 1 month ago]

These historical data points illustrate how the share price has fluctuated over different periods, reflecting changes in market conditions, company performance, and investor sentiment.

Factors Influencing Cellecor Gadgets’ Share Price

Several factors influence the understanding these can help investors make informed decisions:

Financial Performance

The company’s quarterly and annual financial reports significantly impact its share price. Strong revenue growth, profitability, and positive cash flow often lead to an increase in share price, while poor financial performance can have the opposite effect.

Product Innovation

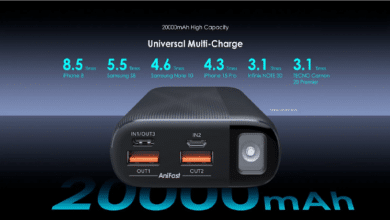

Cellecor Gadgets’ ability to innovate and introduce new products is crucial. Successful product launches and advancements in technology can boost investor confidence and drive up the share price.

Market Conditions

Overall market conditions, including economic indicators, interest rates, and geopolitical events, can influence share prices. A bullish market can lead to higher share prices, while a bearish market can result in declines.

Competitive Landscape

The competitive environment in the consumer electronics industry also plays a role. Cellecor Gadgets’ share price is affected by its market position relative to competitors and its ability to capture market share.

Investor Sentiment

Market sentiment and investor perceptions can drive short-term fluctuations in share price. News, analyst ratings, and social media trends can all impact investor behavior.

Future Prospects for Cellecor Gadgets

Looking ahead, several factors could shape the future trajectory of Cellecor Gadgets’ share price:

- Expansion Plans: The company’s plans for expansion into new markets and regions could provide significant growth opportunities.

- Technological Advancements: Continued investment in research and development to stay ahead in the technology curve can positively impact future share prices.

- Strategic Partnerships: Forming strategic alliances with other tech companies or industry leaders could enhance Cellecor Gadgets’ market position and drive growth.

- Sustainability Initiatives: Increasing focus on sustainability and environmentally friendly practices could appeal to a broader investor base and improve market perception.

Conclusion

Cellecor Gadgets’ share price is a dynamic indicator of the company’s market performance and future potential. By analyzing its current standing, historical trends, and the various factors that influence its value, investors can gain a deeper understanding of its stock performance. As the company continues to innovate and expand, monitoring these elements will be crucial for making informed investment decisions.