Jio Financial Share Price Target 2025: Stagnation or Strategic Growth?

Jio Finance Share Price Target 2025

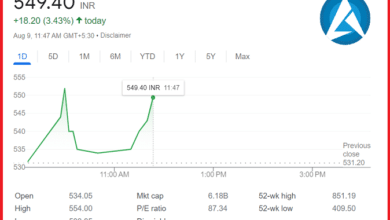

Jio Financial Services Ltd (JIOFIN), a subsidiary of Reliance Industries, has seen its share price hover around the ₹350 mark for several years. This stability raises a crucial question for investors: What does the future hold for Jio Financials’ share price? Will it break free from this stagnation and reach new heights in 2025, or will it remain within a limited range?

Factors Influencing Jio Financial’s Share Price Target

Several factors can influence Jio Financials’ share price target for 2025. Let’s delve into some key considerations:

- Market Performance: The overall performance of the Indian financial sector will significantly impact Jio Financial. A robust financial sector with rising stock prices can propel Jio Financial upward. Conversely, a sluggish market could dampen its growth.

- Company Growth Strategy: Jio Financials’ future hinges on its ability to expand its customer base and product offerings. Successfully tapping into the underbanked segment in rural India and launching innovative financial products could significantly boost its share price.

- Performance of Reliance Jio: Being a subsidiary of Reliance Industries, Jio Financial benefits from the brand recognition and vast customer base of Jio. The success of Reliance Jiro’s digital initiatives and its ability to integrate financial services seamlessly could positively impact Jio Financials’ share price.

- Regulatory Environment: Government regulations and reforms in the financial sector can play a vital role. Supportive regulations that promote financial inclusion and ease of doing business could pave the way for Jio Financials’ growth.

Current Analyst Viewpoint

Currently, analysts seem to have a neutral outlook on Jio Financials’ share price target for 2025. According to some sources, analysts have set a target price of around ₹395, which is not a significant increase from its current price. This implies that experts have a cautiously positive outlook for the company’s future. Jio Finance Share Price Target: 2025.

Reasons for Stagnant Share Price

Several factors could be contributing to the current stagnation in Jio Financials’ share price:

- Limited Financial Data: Jio Financial is a relatively young company compared to established financial institutions. The lack of a long track record of financial performance might make it difficult for investors to assess its future potential.

- Competition: The Indian financial sector is highly competitive, with established players like HDFC Bank and ICICI Bank dominating the market share. Jio Financial needs to carve out a unique niche and demonstrate its competitive edge to attract investors.

- Focus on Organic Growth: Jio Financial seems to be focusing on organic growth through its existing customer base and partnerships. While this approach is cautious, it might not be as rapid as investors might desire.

Potential for Future Growth

Despite the current stagnation, there are reasons to believe that Jio Financial can achieve significant growth in the coming years:

- Leveraging Reliance Jiu’s Network: Jio Financial has the advantage of leveraging Reliance Jiu’s massive customer base and digital infrastructure. This can help Jio Financial reach a wider audience and offer convenient financial services.

- Focus on Digital Solutions: The increasing adoption of digital financial services in India presents a significant opportunity for Jio Financial. By offering user-friendly digital platforms and mobile apps, Jio Financial can attract a tech-savvy generation.

- Government Initiatives: Government initiatives promoting financial inclusion can benefit Jio Financial. By focusing on providing financial services to underserved segments, Jio Financial can contribute to these initiatives and tap into a vast potential market.

Conclusion: A Calculated Gamble?

Jio Financials’ share price target for 2025 remains uncertain. While analysts are cautiously optimistic, the company needs to demonstrate a clear growth strategy and capitalize on its unique advantages. Investors seeking a high-growth stock might need to consider the potential risks associated with a relatively young company. However, for those willing to take a calculated gamble, Jio Financial, with its backing by Reliance Industries, could be a long-term investment opportunity in the dynamic Indian financial sector.