Jio Financial Services: Share Price Gains Momentum

Share Price Of Jio Finance

Jio Financial Services Ltd. (JIOFIN), a holding company for Reliance Industries’ financial services ventures, has seen its share price climb steadily in recent months. This article delves into the current state of Jio Financial’s share price, exploring factors that might be influencing its rise and what investors can expect for the future.

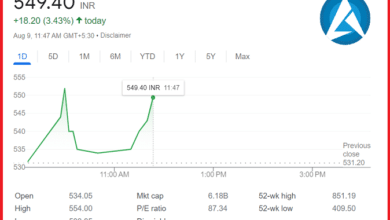

Current Share Price and Market Performance

As of June 3rd, 2024, Jio Financial’s share price sits at ₹356.40. This represents a 3.50% increase from the opening price on the same day. The stock has witnessed a positive trend overall, with a 52-week high of ₹395 and a low of ₹203. The company boasts a healthy market capitalization of over ₹2.26 lakh crore, indicating investor confidence in its potential.

Factors Driving the Share Price Upward

Several factors might be contributing to Jio Financial’s rising share price:

- Growth of Digital Financial Services: The Indian digital financial services market is experiencing explosive growth. Jio Financial, with its backing from Reliance Industries and a focus on digital solutions like Jio Payments Bank and JioMoney, is well-positioned to capitalize on this trend. Investors are likely recognizing this potential, driving up the share price.

- Reduced Debt Burden: Jio Financial has made significant strides in reducing its debt burden. This financial prudence increases investor confidence in the company’s long-term stability and profitability, leading to a rise in share price.

- Expansion into New Sectors: Jio Financial is exploring diversification, with a proposed joint venture with BlackRock for an Asset Management Company (AMC). This expansion into new areas indicates the company’s ambition and potential for future growth, which can further entice investors.

Potential Challenges and Considerations

While the outlook for Jio Financial appears promising, some challenges could impact its share price:

- Competition: The Indian financial services sector is fiercely competitive. Jio Financial faces established players with substantial market share. The company’s ability to differentiate itself and acquire a significant customer base will be crucial for sustained share price growth.

- Profitability and Dividends: Currently, Jio Financial does not pay out dividends, despite reporting profits. This might deter some income-seeking investors. Future decisions regarding dividend distribution could influence the share price.

- Regulatory Landscape: The Indian financial services sector is subject to strict regulations. Any changes in regulations or compliance hurdles could impact Jio Financial’s operations and potentially affect its share price.

Looking Ahead: What Investors Can Expect

Jio Financial’s future trajectory depends on its ability to navigate the competitive landscape, achieve consistent profitability, and adapt to regulatory changes. Here’s what investors can keep an eye on:

- Customer Acquisition and Growth: Jio Financial’s success hinges on its ability to attract and retain customers. The company’s progress in this area will be a key indicator of future share price performance.

- Profitability and Dividend Distribution: Investors will be keenly observing Jio Financial’s future profitability and any potential dividend announcements. These factors can significantly impact the stock’s attractiveness.

- Expansion into New Ventures: The success of Jio Financial’s proposed AMC joint venture and any further diversification plans will be closely watched by investors. Positive developments in these areas could boost the share price.

Conclusion

Jio Financial’s share price has been on a positive climb, reflecting investor confidence in its potential. The company’s focus on digital financial services, reduced debt burden, and expansion plans are promising signs. However, competition, profitability, regulations, and customer acquisition remain key factors to watch. Investors should carefully consider these aspects before making investment decisions. share price of jio finance.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.